The amending Protocol to the India-Mauritius tax treaty has whipped up an industry and media frenzy. Allow me to jump into the fray of tax pundits commenting on the matter, in the hope of drawing attention to a silent threat that has gone virtually unnoticed so far.

Background: from inception, a DTA designed to prevent fiscal evasion

The Protocol has amended the “Convention between the Government of the Republic of India and the Government of Mauritius for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes of income and capital gains” (the “DTA”) dating back to 1983.

Shrewd use of the DTA allowed the avoidance of capital gains tax on the resale of foreign investment in Indian enterprises when the sale occurred at the level of a holding company based in Mauritius, which does not tax this type of gain. This led to nearly 100 billion USD being invested in India through Mauritius over the past 15 years (33.7% of total FDI into India over that period).

Singapore and Cyprus also had relatively similar treaties with India, and likewise served as platforms for foreign investors.

But remember the title of the DTA? It’s not just about avoidance; from day 1 it was also about the “prevention of fiscal evasion with respect to taxes of capital gains”.

Levelling the tax playing field with GAAR and BEPS: ending competition from Singapore and Cyprus

For several years, India had been rattling its sword about the use of Mauritius for illegitimate purposes. The most tangible threat put forward was the GAAR (General Anti-Avoidance Rule), an internal law designed to prevail over the DTA in case of abuse of the treaty primarily to escape taxation.

Although international lobbies managed to get the GAAR postponed, we now face its ineluctable entry into force in April 2017.

In parallel, under the aegis of the OECD, the BEPS package is due to take effect. This refers to Base Erosion and Profit Shifting, the phenomenon whereby companies exploit international fiscal loopholes to artificially shift profits to low-tax jurisdictions where they have no substantial economic activity. BEPS is intended to prevent the use of DTAs to achieve double non-taxation… which is exactly what has been happening with India for the past decades (viz., double non-taxation of capital gains).

BEPS’ main anti-avoidance tool is the Common Reporting Standard (CRS), a multilateral tax information exchange mechanism taking effect in January 2017 amongst 50 countries.

Against this worldwide backdrop, let’s remember that in India, the Modi government actually came to power on the premise of “ending tax terrorism” – a harsh word that conveys the gravity of the issue.

In the wake of the amending Protocol, a review of Indian media shows that the focus lies squarely on the end of round tripping and abuse (not treaty use).

Ostensibly, Singapore is next in line for a treaty overhaul. Last week, Indian Revenue Secretary Hasmukh Adhia tweeted: “Capital gains on shares for Singapore can also now become source based due to direct linkage of Singapore DTAA Clause with Mauritius DTAA.”

Cyprus faces an even more dire fate, considering the stern warning by Mr Adhia about the current treaty renegotiation: “If [Cyprus] are not willing to change their stand, then we have an option of cancelling the treaty also.”

One of the main concerns of our financial services industry had always been that a disruption of the status quo on the India-Mauritius DTA would open a boulevard for Singapore to offer competing advantages to foreign investors. With India’s current explicit stance vis-à-vis Singapore and Cyprus, those concerns can be laid to rest… with one exception.

For in all the affray about competitors, including the outlandish fear that India may now go out and sign more favourable treaties with other States, we only hear deafening silence when it comes to a very real threat: the Netherlands.

A discrete rogue: the Netherlands, house of Oranje

The Dutch?

If you only knew them for their extermination of our Dodo, and their legalisation of cannabis, here’s another reason to be irritated by them.

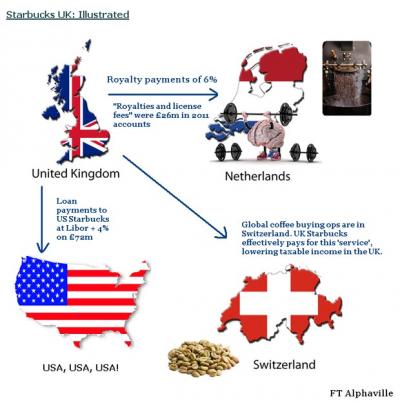

More seriously, the Netherlands uncharacteristically came into the spotlight last year as a nexus for an elaborate tax avoidance scheme called the “Dutch Sandwich” used by Google, Starbucks, Amazon and Apple to pay little tax on billions of euros of profit derived from Europe. While other companies were paying 12% to 30% corporation tax, Dutch-Sandwich users reduced their effective rate to 2.4%.

In late 2015, ActionAid, an NGO which works on tax avoidance issues in 25 countries, sought to draw attention to the Netherlands as an accomplice to tax injustice. It accused the Dutch government of “facilitating tax avoidance on an industrial scale”.

Rather hypocritically, the Dutch Minister of Finance averred that the Netherlands wished to combat tax avoidance during its EU presidency. Yet at the same time, the land of the Oranje was upholding a “sweetheart tax deal” with Starbucks, that is a letter of comfort from its tax authorities whereby the multinational coffee chain’s controversial tax arrangements would not be challenged.

This led the European Commission to order the Netherlands to recover up to 30 million euros in back taxes from Starbucks, on grounds that the Dutch tax deal amounted to “illegal state aid”. In response, the Dutch cabinet merely stated that it was “surprised” by the decision and that it would “study” the European Commission’s order – but not that it would comply with it.

While Mauritius and Singapore are consolidating their reputation as compliant jurisdictions, it is extremely worrying to note the defiance displayed by the Netherlands.

In parallel, a smart minority of Indian press has already picked up on the issue, referring to the Netherlands as the “next favoured investment stop” for foreign institutional investors, due to the advantages stemming from its treaty provisions with India.

Indian media reported the views of tax experts hailing the Netherlands as the logical alternative to Mauritius and Singapore. Thus, the head of the tax practice at law firm Khaitan & Co is quoted in the Indian Express as having said that: “the India-Netherlands treaty is a smart treaty, and it can emerge as a preferred alternative for FIIs especially those in Europe.”

Under the Indo-Dutch treaty, where a Dutch company sells shares in an Indian entity to a non-Indian resident buyer, no capital gains tax is leviable. This CGT exemption also benefits resident buyers if the Netherlands seller company owns less than a 10% shareholding in the Indian company.

In other words, foreign investment structured through the Netherlands can continue to benefit from complete capital gains tax exemption.

This constitutes a very tangible threat for Mauritius (and Singapore), as evidenced by some choice excerpts from the commercial literature of an Amsterdam tax firm advertising the benefits of using the Netherlands as the preferred route for investing in India. It does not hesitate to disparage both Mauritius and Singapore in the following terms: “Mauritius appears less attractive since it has the reputation of an offshore treaty-shopping jurisdiction”, “in case the India-Mauritius tax treaty is amended, this may have similar consequences for the India-Singapore treaty”.

Next we find an outrageous statement: “the Netherlands?India tax treaty is a very stable treaty (compared to the India-Mauritius tax treaty). In addition, there are no onerous conditions attached to proving substance requirements in the Netherlands.”

By the way, the above statements pre-date the amendment to the India-Mauritius DTA. Predictably, the Dutch will now become even more aggressive in marketing their wares.

So while India has been harping on Mauritius and Singapore for years about transparency and substance, culminating in the loss of treaty privileges for both countries, the Netherlands are just waltzing unscathed through the anti-abuse net.

In light of the Netherlands’ history of tax parasitism, Mauritius should join forces with Singapore to lobby for India to immediately revoke all unfair advantages accruing from the Dutch treaty, and to obtain a public Indian Government pronouncement that the GAAR will also target the Netherlands.

Failing this, Mauritius should call the OECD to action vis-à-vis the unacceptable tax distortion peddled by the Netherlands (who, incidentally, is a signatory to the CRS as part of the BEPS package).

INDIA-MAURITIUS DTA AMENDMENT: The real enemy is Oranje

EN CONTINU ↻