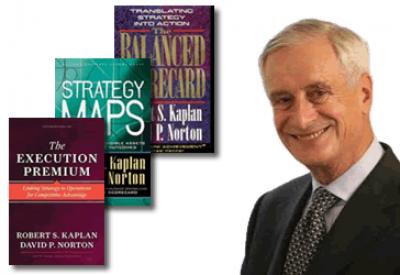

Robert Kaplan’s master class on the Balanced Scorecard held at Trianon Convention Centre in Mauritius on 8th August was a major event uniting over 1000 prospective listeners from various corners of business and management in Mauritius, both from the public and the private sector. At a time when the Mauritian economy is travelling through troubled waters with uncertainties linked with the extension of the African Growth and Opportunity Act (AGOA) for the next fifteen years along with the impending crisis both in European and the US market, the forum held was a means of developing positive thinking on the part of Mauritian managers who find it testing to develop strategies for the survival of their businesses in the coming future. Interviews of managers in the press clearly reveal apprehension of the future with plausible solutions like ceasing business, retrenching a large number of workers and worse relocating to Madagascar, Bangladesh and Pakistan.

Given that the possibilities mentioned above represent a simplistic way of getting out of the business problem, it would be wise to rethink strategy that could be successful to Mauritius in this present gloomy business climate. Kaplan’s Balanced Scorecard, developed in the 1990s from the earlier six Sigma concept, could be a suitable way of devising strategy that could apply to the current Mauritian situation. Basically, finance is the driver for success and companies using this variable as a success factor take immediate action. Pizza Hut is a recent case of a business in financial problems along with a few hotels that could not position themselves within the competitive atmosphere.

Basics of the Balanced Scorecard

The balanced scorecard is a strategic planning and management system that is extensively used in business and industry, government, and nonprofit organisations worldwide to align business activities to the vision and strategy of the organisation, improve internal and external communications, and monitor organisation performance against strategic goals. A revised version of the initial balanced scorecard transforms an organisation’s strategic plan from an attractive but passive document into the organisation’s guidelines on a daily basis. It provides a framework that not only provides performance measurements, but helps planners identify what should be done and measured. It also enables executives to truly execute their strategies.

Application to Mauritius

It would be exacting to devise a framework in this short article for Mauritius but seen from Kaplan’s intervention in front of an attentive Mauritian audience, certain elements of the Balanced Scorecard could be well applied as an interesting business tool for the country. The interpretation goes as follows:

The Learning & Growth Perspective

?This perspective includes employee training and corporate cultural attitudes related to both individual and corporate self-improvement. In a knowledge-based economy that Mauritius is aiming for, people are its key resource. In the current climate of rapid technological change, it is becoming necessary for knowledge local employees to be in a continuous learning mode. Kaplan emphasises that ‘learning’ is more than ‘training’. It includes roles like mentoring and coaching within the organisation, as well as that good flow of communication among workers that allows them to readily get help on a problem when it is needed. To create high performing work systems, both employees and managers must address learning requirements to see how these could improve performance. The Performance Management System (PMS) got mitigated response in the public sector because it failed to clearly relate high performance with rewards and too often punishment.

The Business Process Perspective

?The business perspective refers to internal business processes. Measurement or scores based on this perspective allow the managers to know how well their business is running, and whether its products and services conform to customer requirements. For example, dealing quickly with customer complaints, managing orders on time and creating value within the organisation like using ‘green footprint’, participative style, delegation and empowerment could be essential to reinventing business in Mauritius. A banking system in Mauritius could empower its employees with proper tools to better deal with customers. For instance, the Mauritius Revenue Authority has quite well developed e-filing since 2010 but there still needs more refinement to improve customer response.

The Customer Perspective

?The importance of customer focus and satisfaction cannot be overlooked in any business. These are key indicators given that if customers are not satisfied, they will eventually source other suppliers that will meet their needs. Poor performance from this perspective is a key indicator of future decline. In developing metrics for satisfaction, customers should be evaluated in terms of kinds of customers and the kinds of processes for which companies are providing a product or service. In the Mauritian public sector, customers are both local and external. Potential investors in Mauritius both claimed ‘ease of doing business’ as a facilitator of business and a bureaucratic system that discourages investment. The Board of Investment recently reduced investment applications from three months to a couple of days to better stimulate direct investment.

The Financial Perspective

?The traditional need for financial data is still a scorecard in the Kaplan’s model. Timely and accurate financial information should be a priority, and managers should look into this matter. With the implementation of a corporate database, more of the financial processing can be centralised and automated. Mauritian companies, especially blue-chip ones, anticipate future changes and so do corporations like Statistics Mauritius and MCB Focus. There is a need to include additional financial-related data, such as risk assessment and cost-benefit data, as Kaplan mentioned in this category. Risk assessment in the Light Rail System (Metro Léger) could be useful financial projection regarding the implementation of the transport system and its long-term viability.

Strategy Mapping

Kaplan suggests the use of strategic maps to include the four variables namely finance, business perspective, customer satisfaction and employee learning as critical success factors for future survival. Mauritius adopts most of them since local companies have addressed the issues like ‘high value-added’ (business and customer), training and development (MITD and training schools), reduced lead times with rapid freight forwarding and constant review of finances with established institutions like KPMG Mauritius, Accenture, etc. However, these must be aligned with all types of organisations, large or small, so that the scorecard addresses more than a single financial variable. Delighted customers will always be loyal, trained staff will continue to deliver excellent performance and simplified business processes entail higher level of productivity.

The National Productivity and Competitiveness Council (NPCC) showed a roadmap for success to practising Mauritian managers and it needs to be seen how every manager (out of the 1000 enthusiasts) might apply the Balanced Scorecard and allow Mauritius make better inroads in international business. Finally, Kaplan’s Scorecard is one model out of many and several others can be applied provided that they can be implemented. Or sometimes, scrap the strategy and rework on something new! What counts is that the compressed paper in a ball form already stirs some positive productive action.

Setting Mauritius in the Balanced Scorecard

- Publicité -

EN CONTINU ↻

- Publicité -