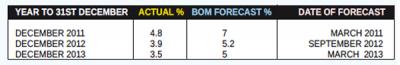

Given the raging chronic debate between Ministry of Finance (MOFED) and Bank of Mauritius (BOM) on monetary policy stance in particular REPO rate, it is imperative that we professionalise not only the debate on the direction and impact of REPO in the wake of the Monetary policy Committee decisions, but also ensure that all decisions are based on quality and accurate forecasts. The above table clearly indicates how inflation forecasts by Bank of Mauritius have been failing and on the higher side. For the last three years, we can see the marked difference between actual and forecast. The latest inflation forecast for the year 2014 is 3.9 to 4.3 per cent by BOM and this looks realistic given the low rate of economic expansion expected this year. If we accept the growth forecast of below 4 % by IMF till 2019, then a period of price stability should be expected.

Forecasting is a very delicate exercise and some margin of error is acceptable. However consistent inaccuracy of forecasts on which monetary policy is based with its implications on economic decisions of major stakeholders can jeopardize and misguide policy decisions. In fact, all economic indicators including growth should be well predicted. But given the complexity of our economy and external factors, it would be more trivial to forecast growth rate. However, it seems that during recent years, the forecast of growth rate has improved.

Credibility of Inflation Forecasts

- Publicité -

EN CONTINU ↻