Let’s keep it simple so that even the most childish of MCB managers can understand. When you set out to be petulant, you should take care that you don’t end up being puerile.

I shall not comment on the unmitigated trash that Mr. Forget has served the readers of L’express, but one monstrous howler deserves to be pilloried, namely that the MCB is “the most democratic of banks”.

Some democracy! The Annual Report 2011 of the Bank gives the lie to its No. 3, who apparently does not understand his own bank statistics. There are curious gaps in his business education, but his training is obviously not yet completed.

The MCB Annual Report says (p. 44) that 381 shareholders out of 18,314, control over 70% of the shareholding of MCB, while another 303 control 8.4%. Add to this that MCB Ltd owns 5.12% of its own equity and you have less than 700 shareholders out of more than 18,000, who own 83% of the bank. And when you dig a little deeper in the respective holdings you realize that the incestuous relations between members of the same group and cross board memberships give to a handful of families the absolute control of MCB. The simple truth is that 16,628 shareholders own only 16,628 % of the MCB while 685 own 83% of its equity. Some democracy.

When one is paid over Rs 18 million annually as Director (Ibid p. 38) one can feel under an uncontrollable compulsion to come to the rescue of one’s employer. While this compulsion is understandable, it could have been more intelligent. Arrogance is no substitute for maturity.

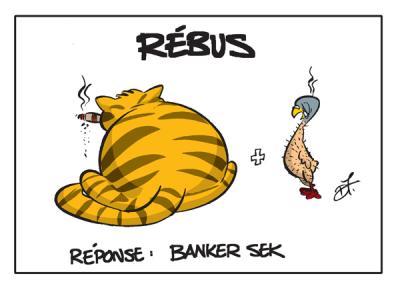

Fat Cats and Pigeons

Let me make it clear. Objections to the obscene profits of MCB and SCB, the two behemoths, are less driven by their quantum than by the manner in which these profits are made. Best Practice, Ethics, Transparency, Accountability, Good Governance – are mostly strangers to them. Their operations are guided by greed and the profit at all cost is the powerful trigger that activates them.

We would have liked to read Mr. Forget on best practice, unfair charges, high cost of loans, of transfers to overseas students, Financial Ombudsman, rotation of Auditor’s Firms, but this is beyond his knowledge or experience. His colleague Anthony Withers, who has worked at Lloyds, could have briefed him.

The cats are the Bankers and the pigeons are us, you and I, beleaguered victims who have no recourse or redress against the predators. And far from being realistic and admitting that best practice is alien to them they insist they are just doing business as usual.

And MCB does not just dominate, it tries to crush competition. It is so protective of its commanding position that it keeps a watchful eye over the activities of other banks which are quiescent and submissive enough to adopt a “Me Too” approach by charging the same unfair fees and rates, instead of adopting a more innovative stance and offering better terms to customers. But their marketing and services remain petrified, not to say outdated. They do not seem to have heard of product differentiation, market segmentation, loss leaders, research and development, customer relations strategies, innovation.

And Government is accessory to this state of affairs because it continues to favour one bank, SBM, to the exclusion of almost every other bank. While that policy was tolerable when SCB was a fledgling institution it is no longer justified in light of recent developments and the proliferation of banks on our shores.

Those who live in glass houses

Finally, I am not interested in exchanging barber comments with anyone unable to grasp the fundamentals of a discussion. But this exposure may lead some readers to think a little more about the potential power that they represent and could use. To begin with, procedures for switching banks should be made easier and more practical – they will then realise that there is an alternative to queuing up for 45 minute for service at MCB counters.

Finally, MCB shelters so many skeletons in its cupboard that it has forfeited the right to pass judgement on companies or individuals. When one lives in a glass house one should avoid throwing stones. This is a lesson the NO. 3 of MCB has still to learn.

P.S. I have to make a distinction here between Pipo Forget, whom I have taught in Forms I and II at RCC and coached for HSC, and the No. 3 of MCB, the passionate protagonist of his bank. While I harbour real affection for the former, I confess I am at a loss to size up the latter.

THE FUNDAMENTALS OF A DISCUSSION: Cats Among The Pigeons

- Publicité -

EN CONTINU ↻

- Publicité -