Lately, Tom Cruise’s teenage character in the 1983 movie, Risky Business, has been coming back to my mind repeatedly. In the movie, Tom wins the confidence of his parents that he can look after himself while they are away. Soon after his parents leave, Tom calls in a hooker, wines and dines with borrowed money, throws out an out-of-control party, has his mum’s precious belongings and family’s furniture stolen by a pimp and thrashes his father’s Porsche. Out went an effective oversight and in came an orgy of unrestrained risky business. The endless serial on the ugly feud between the BoM and the Ministry of Finance makes Tom Cruise blowout look like a cool get-together at Mother Teresa’s house. The latest episode in the serial and the Great MPC Leak are yet another degenerated cock-fights for world entertainment.

One of the worst concerns that had haunted central bank Governors prior to the 1980s was the abusive use of central bank policy tools and facilities by reckless Finance Ministers to pursue their own political agenda. Literature is littered with cases of Finance Ministers abusively using central bank facilities to finance pork-barreling projects on the eve of General Elections. Finance Ministers had always abhorred a hike in interest rate by their central banks even when the best interests of the economy so warranted, because hikes in interest rates ruins the political lives of irresponsible Ministers of Finance.

Literature is also littered with central bank Governors having crossed the Rubicon line and gone terribly wild like lawn mowers having gone berserk. Examples of central banks that have had a one man-wrecking crew as Governor are aplenty in central banking literature. Central banks, with a one-man demolition band as Governor, are dangerous central banks. A highly respected Central Bank Chief in North America in the early 1990s once said HE is the Board of the Bank. He was shown the exit door.

In the wake of financial sector liberalisation, a consensus was reached by the world’s major central banks and Governments. The consensus was that, because Finance Ministers are essentially politicians who have a strong propensity to make an abuse of monetary policy tools, central banks should be given independence with defined objectives to be achieved and, importantly, Governors would be made accountable. Politicians, because of their short and unpredictable tenure of office, generally take a short term view of the economy whilst Governors take a long term view. A clear division of responsibility was thus eventually made. Governors would be responsible for monetary policy and Finance Ministers for fiscal policy. When granting independence to the Bank of England, Gordon Brown had cleverly put it as “instrument independence”. In other words, the Governor was given an apparatus known as the Monetary Policy Committee to decide on monetary policy without the interference of the Chancellor of Exchequer. I construe the grant of “instrument independence” to the Governor as no independence on matters other than monetary policy making. On other matters the Courts or the Board as we call it in Mauritius, not one person in the name of the Governor, is the supreme body of the Bank.

Once Mauritius embraced financial sector liberalization, and rightly so, in 1980s the lie of the land changed dramatically and the rules of policy games changed accordingly. The BoM lost its sovereignty in monetary policy making. By this it is meant that the BoM is no longer in a position to decide on its monetary policy stance independent of monetary and financial developments in foreign markets. Monetary policy making became more complex and more demanding. It’s a universal feature in our globalised world that called for heightened sense of responsibility in fiscal and monetary policy making.

In 2004, under my watch as Governor, the Bank of Mauritius bill was passed in the National Assembly. The Bank was granted independence. The Act was proclaimed in early 2005. The Act made provisions for the setting up of a Monetary Policy Committee. When making provisions for the MPC in the BoM bill I was guided by the belief that our 21st Century Governors and Finance Ministers would run the show competently with an elevated sense of responsibility. I concede it was an utterly naïve belief.

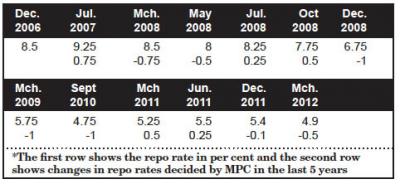

Just study the table below. Anyone who has not taken leave of his senses will necessarily conclude that the rhythm and direction of changes are out of tune with the state of the economy. Have MPC members been looking at what they have been fabricating in the past? It’s mind-boggling.

The trends defeat economic wisdom. Show the above series of changes that have been decided upon by the MPC over the last five years to any respected central bankers or professional economists and academics overseas – not from those paid by the BoM or Government or from economists who are expert piano players in whorehouses – and ask them what could be the policy objective aimed at by the MPC. We will be told something like this: “The policy objectives have alternated rashly between inflation and growth within very short intervals. The series of decisions are senseless – an itinerary without a firmly set destination. MPC decisions are neither growth promoting nor anti-inflation. MPC decisions are not predictable and are thus utterly bad for the financial markets.” An econometrician would say that the decisions to change the repo rates and the quantum of the changes are like the unsteady and random steps of a drunk leaving the bar for his house but will ultimately end up knocking at someone else’s door. MPC decisions have been erratic, inconsistent, incongruous and incoherent when seen against the backdrop of the exigencies of the time. MPC decisions have caused untold injury to the economy.

On the one side, we have had two Finance Ministers’ men rightly holding the flag for growth stimulation and on the other side we have had the BoM band trumpeting for anti-inflationary policy stance. BoM band has belatedly understood that growth is important and hence the need for a reduction in the repo rate. But wait. The problem is about quantum now. Are our financial markets and our economy so much sensitive and so highly sophisticated that a difference between a reduction of 50 basis points and one of 25 basis points matters to a point that BoM should get that distressed? Wow!! Somewhat like Bill Clinton would say: it’s growth, stupid.

I care no more whether or not the Governor has been out-voted. What matters to me is the policy outcome over time. MPC has been an enterprise quite costly to Mauritius. MPC has been a failure and a waste – regrettably. There is a great ongoing debate right now about central banking with the brilliant Kenneth Rogoff in the lead. The thesis is that the dominant framework guiding central banking practice needs to change. Central banks should go beyond their traditional emphasis on low inflation to adopt explicit goal of financial stability. Macro-prudential tools should be used alongside monetary policy in pursuit of that objective.

A Short Non-Technical Perspective on Central Bank Independence and BoM Monetary Policy Committee

- Publicité -

EN CONTINU ↻