Over the past year, oil prices on the world market have plunged from a high US $ 110 per barrel in June / July 2014 to a low US $ 47 per barrel in October 2015. The average oil price for 2014 was US $ 98.95 per barrel (BP statistical review of world energy June 2015) and for 2015 the average is currently US $ 53.28, a drop of 46%, and in current Mauritian Rupees the drop is 40%.

Although oil prices have plunged, local retail motor gasoline, diesel and LPG (liquid petroleum gas, also known as gaz ménager in Mauritius) prices have not moved much.

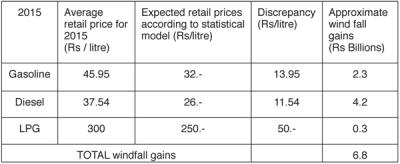

Over the same period gasoline prices have gone down by only 10%, diesel prices by 12% and LPG prices unchanged. Clearly something is happening at the local level. For the past 15 years we have been very much interested in energy issues and we have drawn up a number of statistical models that correlate oil prices to the local retail prices of gasoline, diesel and LPG in current Rupees. We have also computed an approximation for the windfall gains for Government based on price discrepancies between average retail prices and expected retail prices and volumes of fuels consumed in the country. The following table summarises our analysis.

It is quite clear that during 2015, Government has reaped and will reap significant windfall gains which we estimate to be of the order of Rs 6 to Rs 7 billion accruing from the fall in world oil prices. The question that needs to be answered is why has Government not passed some of this windfall gains to the public? Is it because of some losses accumulated because of hedging? Is Government using the windfall to reduce spending deficits? Or is Government saving some of the windfall gains to invest elsewhere? Either way, the onus is now on Government to inform the voting public what it intends to do with the windfall gains.

Although it is notoriously difficult to predict future oil prices, the currently low prices may persist throughout 2016. If that is to be the case, then it follows that the windfall gains will accumulate next year also. The current price structure cannot hold. Any reduction in fuel prices will inevitably leave more money in the pockets of citizens, a most welcomed boost right now.

World Oil Prices, the Mauritian Economy and the Fuel Pump, what interactions?

- Publicité -

EN CONTINU ↻